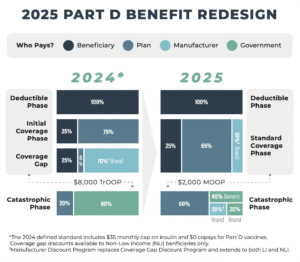

- 2025 Medicare Part D enrollees will no longer owe a 5% coinsurance on prescriptions after meeting the catastrophic coverage threshold

- Annual maximum out-of-pocket (MOOP) expenses for Part D will be capped at $2,000

- Maximum out-of-pocket cost-sharing for Part D-covered insulin products will be capped at $35 per month

Currently, after reaching $8,000 to qualify for catastrophic coverage, beneficiaries still face some drug coinsurance costs, with no limit on the total out-of-pocket drug expenses they could incur. Eliminating the 5% coinsurance could benefit up to 1.3 million Part D enrollees while capping maximum out-of-pocket (MOOP) costs is expected to assist an additional 100,000 beneficiaries.

Insulin, a drug 3.3 million beneficiaries rely on, saw its price nearly triple between 2002 and 2013. The $35 cap on out-of-pocket cost-sharing for insulin, combined with the elimination of the 5% coinsurance and the caps on Part D out-of-pocket costs, will help ensure this life-saving medication remains affordable for beneficiaries.

The Inflation Reduction Act (IRA) goes beyond the $35 insulin cap. Starting in 2026, monthly copayments for insulin will be the lesser between $35, 25% of the maximum fair price (for insulin products selected for negotiation), or 25% of the negotiated price in Part D plans.

Infographic for 2025 Rx Changes

Share this helpful infographic with your members to explain the changes to Medicare Part D between 2024 and 2025 more easily.