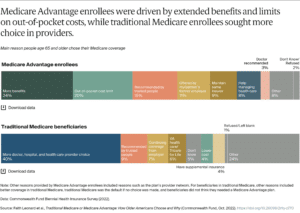

A recent study published by the Commonwealth Fund shows major shifts in the type of healthcare plans seniors plan to choose in 2023. According to this survey, seniors are expected to purchase Medicare Advantage over traditional plans for several factors, but most namely because of the perks.

Medicare vs Medicare Advantage

When looking for health coverage, beneficiaries have two options: traditional Medicare coverage or private Medicare Advantage (MA) plans. MA plans typically cover the cost of a handful of benefit expenses that Medicare doesn’t cover, such as eyeglasses. Traditional Medicare plans have a larger provider network without needing prior approval from a primary care physician. There are advantages to either Medicare plan, but beneficiaries have historically chosen a traditional Medicare plan. However, “forty-five percent of Medicare beneficiaries are enrolled in Medicare Advantage plans in 2022, a share that is projected to rise to more than 50 percent by 2025,” according to the survey conducted by the Commonwealth Fund.

Medicare Advantage Offerings

The increase in MA enrollments is attributed to the inclusion of perks like vision and dental included in the plan premium as well as limits on out-of-pocket costs. Though traditional Medicare offers a more flexible provider network, it’s likely that if the beneficiaries’ health needs revolve around ancillary products or are spending high out-of-pocket, a Medicare Advantage plan could lower their health expenses. It’s important to discuss a wide range of health goals with your client as you help them identify coverage for 2023 to choose Medicare vs Medicare Advantage plan.

SOURCE: www.CommonWealthFund.org

What does this mean for you?

Even with an increase in MA enrollments, 4 in 10 people are choosing Medicare coverage because of the flexibility. Whether a beneficiary is choosing a traditional plan or a private Medicare Advantage plan, make sure you have done all the necessary research to provide them with the best solution! Help your clients wade through all the Medicare marketing and information available to them by showing them that you are their trusted resource for all things Medicare. If you’re looking to brush up on your sales strategies, be sure to check out our blog.

__________________________________

As your North Carolina Medicare FMO, Carolina Senior Marketing is committed to serving you, the Independent Insurance Agent. If you’re not an agent with us, we’re still glad to meet a new face and answer any of your questions you may have. Please email us at [email protected] to reach out.